Data science and bid management are converging

Do you have line of sight visibility of your bid risk and performance?

The cost to your business for the chance to win a contract is considerable, and winning the wrong project can financially ruin your organization. In large corporations, the cost of bidding for work for a chance to win one in five bids is around three percent of a contract’s value (1,2). Smaller companies, meanwhile, pay as much as six percent of their turnover with even smaller odds of success (3).

Too often, bidding teams focus on opportunities to fill their pipeline and submit proposals for the business, but an inherent risk exists within bidding when pursuit becomes a numbers game. It is the processes and the decision-making that ultimately determine contractor bidding success.

Capability to accurately predict and effectively manage bidding risk and cost factors is critically important and can give your organization a major competitive advantage – if your bidding team captures the right data throughout the bidding cycle.

If your business runs multiple bids simultaneously, how are you tracking and reporting your key metrics and other time-series process measurements throughout your organisation?

Bid analytics in bid management

Until recently, bid analytics have been extremely difficult to implement. The challenge with measuring the true cost and return on investment in bidding boils down to the complexity of activities performed across the various stages of a bid and the sheer volume of variables that impact outcomes.

Since research into competitive bid modelling started in the 1950s, predictive analytics regarding bid outcomes has largely focused on pricing data (4,5,6). But it is insight, not just hindsight, that delivers the greatest benefit for using analytics in bid management.

Today, new developments in bid automation, big data and machine learning are converging to solve long-held issues with bid risk management. This includes the capacity for an impartial bid/no bid decision, plus the ability to identify and understand problems or to identify a competitive advantage. The power to factor in qualitative and quantitative historical data, and to apply hypotheticals to scenarios and review their impact upon the business delivers the potential to transform an organization’s competitive performance.

Bid teams and organizations can take simple steps today that will build business value and lay a strong foundation for a roadmap of data, analytics, and advanced machine learning as this emerging technology matures for the bidding industry.

Closed-loop continuous improvement systems

Unlike their sales counterparts who rely on customer relationship management (CRM) systems, most bid teams have lacked effective systems for centralizing and standardizing bid management processes end-to-end. And, as a result, bid management practice has typically remained in silos and workflow digitized in patches. Perhaps this practice results from major decisions that have been made on heuristic assumptions by key players who have relied on their own knowledge and learning strategies, and possibly why solution design has traditionally relied on tacit knowledge from these key individuals.

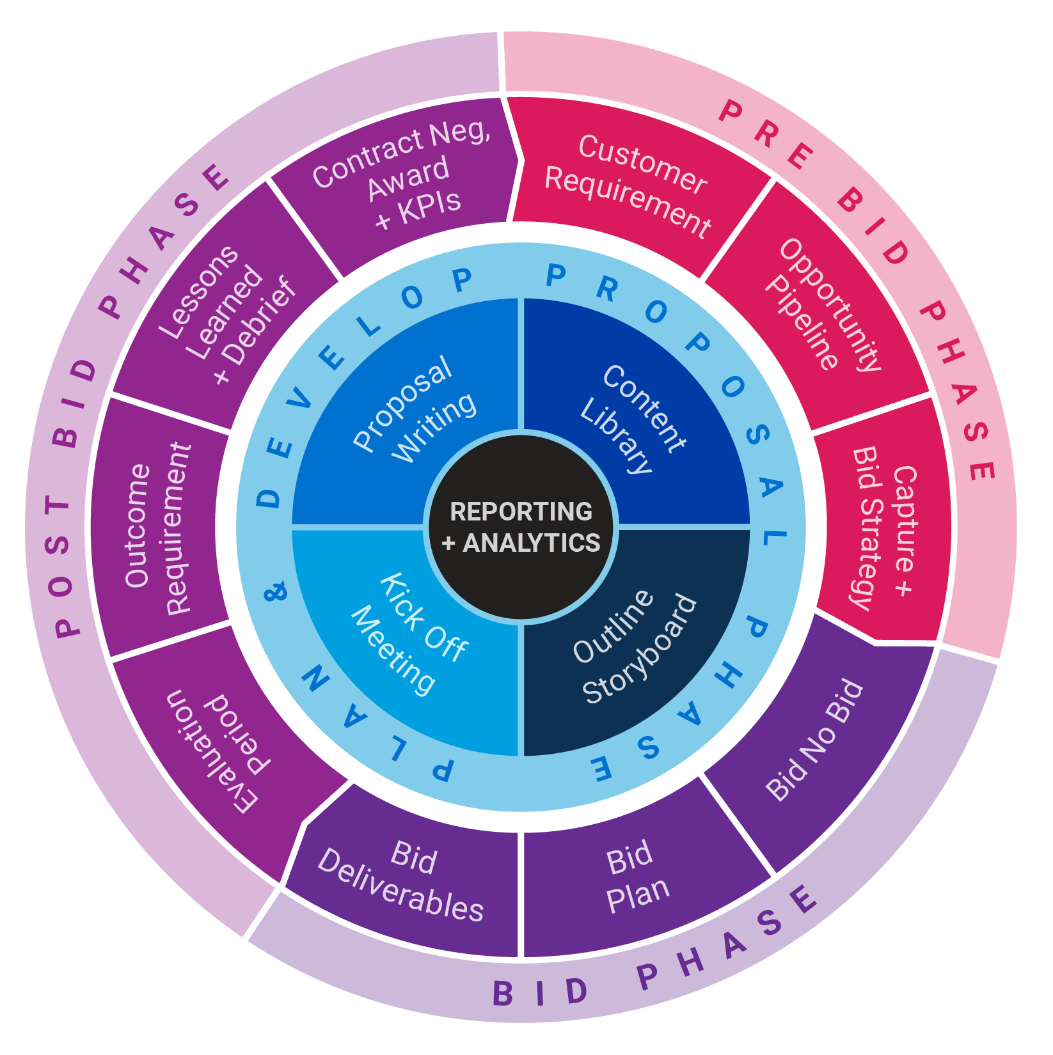

Closed loop continuous improvement systems have been researched and successfully applied in quality management practices across industries such as manufacturing, banking, supply chain, and customer service. A closed loop system facilitates the standardization and capture of data across an entire workflow or connected processes — making it ideal for bid management and analytics of key metrics captured across the end-to-end process to work effectively as illustrated in Figure 1.

Source: Nyree McKenzie, Bidhive

Figure 1: Bid management end-to-end process as a closed loop cycle

Among other benefits, by capturing all inputs and metrics across an end-to-end process, the closed-loop continuous improvement system and its data become more valuable to the bidding organization over time as it learns the relational factors and data variables generated by pricing, competitors, customer evaluation, or even different bid teams.

Machine learning now makes it possible to process tremendous amounts of data much faster and more comprehensively than human capabilities could manage. But first, companies must capture rich historical bid data – ideally in a closed loop continuous improvement system – for analysis.

Optimizing bidding data for analytics

The usefulness of bid data for analytics relies on training datasets of standardized and categorized data.

In its raw form, bidding data can be difficult to use. It’s often fragmented and inconsistent, but the primary issue with bid data for analytics is missing contextual information, such as the team who worked on the bid, the buyer that chose the solution, and the other bidders in the competition. As patterns change over time, the type of data can become extremely complex and unstructured.

To overcome these issues, new methods for capturing, aggregating, and correlating historical bidding data into machine-readable formats are now being made available.

Meanwhile, the bidding organization can start to build analytical capability by applying quality rules to data and processes. Embedding data standards into bid management systems via mandatory fields or drop-down lists will assist the bidding process with consistent data capture, categorization, and standardization. Implementing a culture of data quality and analysis, such as a documented win-loss review process after each bid is submitted will capture that critical contextual data required to drive the business to a point where analytics can provide reliable decision-making support.

What data should bid teams capture?

Whether a continuous improvement system for bid management has been implemented or not, the valuable bidding data that companies can begin to collect and categorize includes (but is not limited to):

- Buyer/customer

- Opportunity description

- Procurement method

- Company business line

- Bid/no/bid decision

- Bid team

- Win/loss outcome

- Contract award price

- Competitors.

What bid metrics should bid teams be tracking?

For companies starting on a bid analytics journey, a good starting point is to consider defining some questions and then identifying the data that you know is relevant to answering important issues.

As examples:

- Capture the number of incoming tender opportunities and create a digital bid register (or bid board).

- Track how many bids progress from open market to qualification, to bid/no bid, to submitted, and won/loss.

- Analyze bids submitted and won by value, and by volume.

- Compare win/loss ratio (won bids compared to lost bids).

- Capture ratio (won bids divided by qualified submitted bids).

- Determine win ratio for customers, both new and incumbent.

- Cite reasons for bid/no bid decisions, and win/loss outcomes.

- Determine diversity of customers.

- Discover percent of bids to core customers (total bids from core customers/total number of submitted bids).

- Research opportunities month-to-month (are they increasing or declining? Do seasonal trends exist?).

- Mark up (or profit margin) the percent of influence on the win ratio.

- Research the percent of bids across business lines.

- Know your team resources and capacity.

Qualitative data of value includes reasons for won/loss outcomes that can help the business to uncover opportunities for additional training, resources, pricing strategy or alternative teaming which can influence an outcome.

What will we learn?

Predictive analytics can help you identify, with a high degree of probability, what will happen in the future. Then, more advanced prescriptive analytics can optimize the data to make recommendations for developing a strategy based on factors surrounding situations or scenarios, resources, and past or current performance.

In a practical setting, prescriptive analytics would help companies forecast their pipeline, and the resources that will be needed or impacted if anything changes. Summarizing and using this information could not only deliver substantial efficiencies but it would allow companies to free up their business development time to refocus on other, higher value pursuits or activities.

Within a bidding context, you can use predictions to provide scores in rank order of likely future performance such as the likelihood of a bid progressing to next stage; or its probable success or failure; and likely profit margin of the contract; plus, additional revenue opportunities which can ultimately determine a bid/no bid decision.

We can also use the data to optimize bid processes and support corporate strategy by using correlation analysis to drill down and diagnose why certain events took place. As an example, ask yourself, was the win-to-loss ratio low because of poor bid qualification, misaligned solution, or pricing strategy; or was it symptomatic of something greater within a business line or team?

Generally speaking, managers can reduce the variability of outcomes by using data analysis to identify root causes from correlations or to adapt their strategies with more clarity, such as reasons why a business line is consistently winning or losing bids in a particular market.

Other important implications for a closed loop continuous improvement system in the future include recommendation engines that use machine learning to enable contractors and suppliers to search appropriate bidders and vice versa. The technology would open competition for procurement to discover unknown companies which are suitable for its tender. Conversely, it could connect bidders to new opportunities that are not already in their pipeline. By working bio-directionally, the system would be able to unite people, processes, and information across the value chain.

Conclusion

For a mission critical function like bid management, designing a model that can drive decisions and actions to reduce risk in near real time will be a key differentiator for companies seeking to achieve competitive advantage. This will free up bid teams to make the most of their ability to strategize.

Companies that are already planning their data roadmap and analytical capability and understand the business context and how it applies to the bidding processes will achieve the greatest impact with the technology. But, as with anything strategic, it will be the people, not the technology, who make sense of the data and give it meaning.

END NOTES

- Turner, J.R. (Ed). (2003) Contracting for project management. Burlington, VT, Aldershot, Hants, England: Gower, Ashgate Publishing Limited, p. 118.

- Deloitte Access Economics (2015). Economic benefits of better procurement practices, Consult Australia. p. 22.

- Dalrymple, J, Boxer, L., Staples, W. (2006). Cost of tendering: Adding cost without value? Clients Driving Innovation: Moving ideas into practice (12-14 March), Cooperative Research Centre (CRC) for Construction Innovation, p.9-10.

- Rothkopf, M. H. (1969). A model of rational competitive bidding, Management Science 15(7): 362–373.

- Rothkopf, M. H.; Harstad, R. M. (1994). Modeling competitive bidding: a critical essay, Management Science 40(3): 364– 384. http://dx.doi.org/10.1287/mnsc.40.3.364

- Harstad, R. M.; SašaPekec, A. (2008). Relevance to practice and auction theory: a memorial essay for Michael Rothkopf, Interfaces 38(5): 367–380.