Bid/No Bid Decision – Qualifying an opportunity

Why is it important?

Bid qualification is the front door to opportunities and having a bid/no bid decision process results in routing deals to the right experts to ensure your organisation optimises time and resources to pursue the most appropriate opportunities.

Qualification ensures you pass the minimum requirements around capability and capacity before wasting effort on an opportunity that will go nowhere. If your organisation cannot confidently meet all criteria then it should move on to a more appropriate business target.

As we know, preparing a bid response can be a very time consuming and a costly burden on your organisation. When the success and ultimate return on investment of your bidding and contracting activity is paramount to your organisation’s ongoing commercial sustainability, it is important to consider up front whether the time and resources put into a bid is going to provide you with the anticipated returns.

Deciding on whether to invest in the time and cost it takes to bid for an opportunity often requires a considered Bid/No Bid decision, and an organisational-wide process supporting it.

The Bid/No Bid decision (sometimes referred to as ‘go/no go’) should not be merely a line item or a yes or no decision in your business development process or opportunity management system. As your organisation grows, the Bid/No Bid decision may be the most critical consideration it makes.

Bid/No Bid objectives

The main considerations for a Bid/No Bid decision are:

- Are you in a position to win? (incumbent and competition)

- Can you do it? (capability and capacity)

- Do you want to do it? (attractiveness of the project / service contract aligned to strategic direction)

Essential tools

Case study: Lessons from the Carillion collapse

In 2018, the UK’s second largest construction company, Carillion, collapsed after losing money on major contracts and running up huge debts. The company’s demise sent a ripple effect throughout the construction industry, with smaller private sub-contractors some of the worst hit. Despite having secured more than 450 contracts, it only took three or four unprofitable contracts to topple the company into insolvency. Carillion incentivised senior managers to aggressively bid to secure contracts, which which left no margin for delays and cost overruns.

In a stretched and uncertain environment where cost versus quality may be a deciding factor, or overall demand is stagnating then many contractors may find they have little alternative but to aggressively reduce their bid in order to secure contracts and keep work and money coming in, in the hopes that things will improve in the future.

Learn more about the collapse of Carillion. Could a better bid/no bid governance process saved its demise?

Bid governance

Before deciding on whether to bid on a contract opportunity, it’s important to assess your competitiveness and capability to bid, win and deliver the contract against a range of influencing factors.

Being able to identify the most critical factors to your organisation, as well as archiving previous decisions, lessons learned, debriefs and contract outcomes can help you analyse historical data and assess multiple opportunities at a given point in time.

Some suppliers and contractors find the process of ‘where to start’ overwhelming because the key bidding variables and evaluation criteria drivers can vary so much from one bid opportunity to the next.

A bid/no bid governance process is a good first step to designing your assessment tool.

For many organisations, a bid no/bid decision tool can be a simple checklist that contains set criteria. Others may need to conduct much deeper analysis that consider contract value, profit margin, solution complexity, capability, and historical performance.

Risk assessments will often be required at various stages of the process to guide judgement in making an ultimate decision on whether to pursue and submit due to imprecise or vague project characteristics, customer vision, market forces, competition and supplier assessment criteria.

Bid/no bid decisions are informed by a range of internal and external factors and validate that you are properly positioned to win and deliver based on your capture or opportunity plan. For large, complex pursuits (eg. non-standard solution and/or medium to high value contracts) an organisation may have a gated qualification process that spans any or all of the following:

opportunity identification

pre-qualification to pursue

bid/no bid and validation decision

business case reviews/senior management reviews.

For smaller, more routine bids, companies often have a single decision. Regardless, the final bid/no bid decision milestone should be documented against pre-determined criteria, with the level of decision maker(s) involved commensurate with the probability of win, risk, value and investment.

Factors that influence Bid/No Bid decisions

Since the situations and requirements vary from contract to contract, across industries and from project to project, there is a high probability that there is no single set of factors that will reflect all situations and requirements.

The fastest, and easiest way to increase your ratio of winning bids is to not bid when your chances of winning are zero. very low, or below the bid threshold you have fixed. The last thing you want to do is drain resources unnecessarily. Unfortunately, many sales-oriented organisations have traditionally tried to respond to as many opportunities as they could to hedge their bets, but as we know, tried and tested success rates show that you should do exactly the opposite. This is because the higher the contract value, the more rigorous the bidding process and the higher the risk becomes, so quality, not quantity, will improve your success rates.

Bidhive’s Bid/No Bid decision tool can be customised to your own factors, questions and your assessment criteria, giving you a consistent, data-driven approach to your qualification and capture process.

Understanding the variables

A Bid/No Bid assessment commences with investing the time to understand the opportunity, and gathering critical intelligence on the customer and the project / contract opportunity.

The capture process however, can provide running insights that will help you not only identify bids that you have a good chance of winning, but those that you are most likely going to lose.

When your organisation is faced with several opportunities at once, you need to be selective when choosing work that you bid for. The decision is not only about considering the probability of winning, but also whether your organisation can undertake and complete the contract as planned within the anticipated profit margin and level of risk.

If you rank your pipeline into deals from highest to lowest win probability it will become easier to prioritise and craft logical a business case as to why quality matters, not quantity. After all, if you bid for all the long shots you’ll simply end up spending a lot of money and you’ll lose a lot of bids (not to mention risk losing your team members too).

Building a Bid/No Bid decision tool for the first time

1.Define ‘categories’ of factors

The decision to bid is a complex decision requiring simultaneous assessment of a large number of highly interrelated variables. While many companies go on ‘gut feel’ for their Bid/No Bid decisions, others use quantitative criteria in the decision-making process to allow the Business Development team to decide on the reasonable probability of a win which is objective and free of emotional bias.

The most frequently used tool for identifying factors around the bidding decision is the questionnaire. The advantages are its relatively low cost and the ability to obtain answers in a relatively short time. The disadvantage is that it can often lack objectivity.

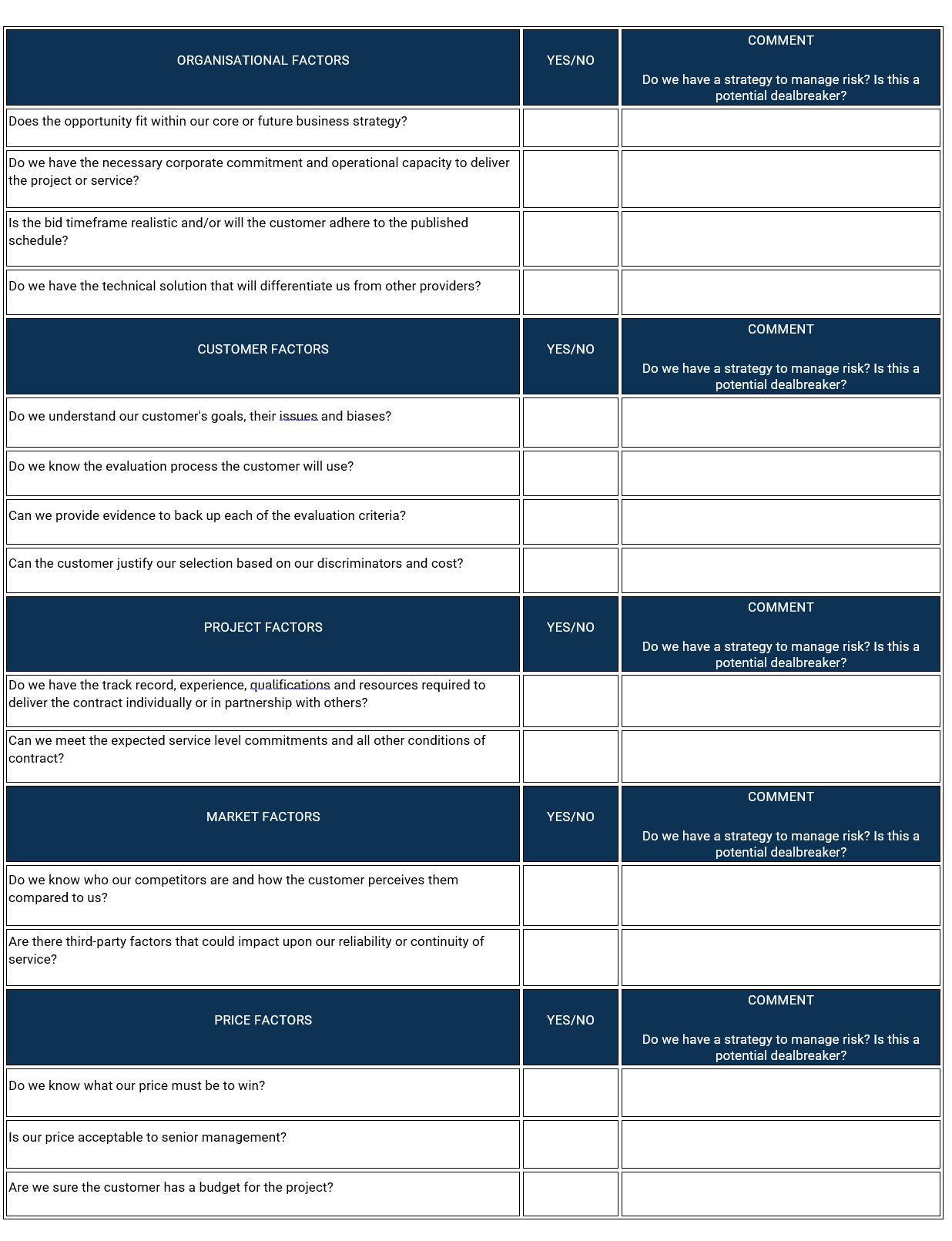

Bid/No Bid influencing criteria can be classified into different categories that consider economic conditions, bid documentation, tendering situation, project or contract-specific characteristics and organisational characteristics. You might organise them like this:

- Organisational

- Customer

- Project

- Market

- Price

The internal factors relate to the organisational capabilities and resources, while the external factors relate to market and project conditions

2. Choose the factors and decision criteria relevant to your organisation

There are no magic number of factors or decision criteria you should choose and they will vary across industries and different market conditions.

More complex bids such as those in international markets and/or the construction sector where risk and cost is high might include a multistage sequence rather than one singular decider step.

These bids might consider country and/or market risk vulnerability, company performance, profitability and probability of winning based on specific scope of work.

By way of example we have provided a simple example of a Bid/No Bid Assessment below.

3. Assessing and evaluating relative importance of the Bid/No Bid factors

Once the categories of factors and decision criteria have been selected, you’ll need to construct your tool using a qualitative or quantitative method (or a mixture of both).

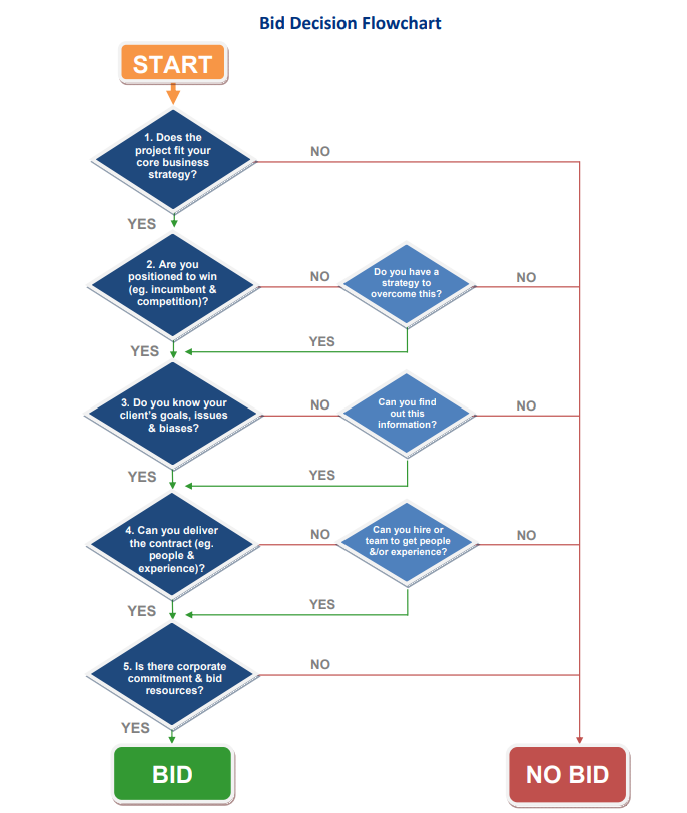

A simple tool to guide you may be a decision tree with a series of yes/no questions with disqualifying criteria (‘dealbreakers’). Other types of bid/no bid methods may include a a true/false or pass/fail checklist to screen initially against compliance requirements; or you may prefer a weighted score structure (for example 1 to 5) based on your own gate review evaluation score card.

Source: Bid decision flowchart, Shipley Associates

Beyond capturing point-in-time decisions, by aggregating your decisions including reasons why you chose to Bid/No Bid and then comparing these against win/loss and project outcomes data, you will begin to see correlations and/or opportunities for improvement.

With Bidhive’s bid/no bid tool organisations eliminate time wasting or high risk efforts by focusing on opportunities that have the highest probability of winning.

Of course there is no single right or wrong way – or set way – to perform your Bid/No Bid assessment – but over time as you build your data set you will begin to see patterns that will help you make more confident decisions based on data, not gut feel.

4. Who makes the Bid/No Bid decision?

Simple proposals that have little impact or are low risk to the business could be decided upon by one or two people. More complex bids, however, may need the involvement of the bid and delivery teams in the Bid/No Bid process, including a series of gate reviews, with ultimate executive decision making at the delegated executive or Board level.

In these instances a Risk Assessment may be required. Occasionally, a No Bid decision may need to be made for opportunities that would have previously been given the go ahead, such as times when it’s necessary to survive low economic cycles, and periods of abundant project activity in the market.

Bid and delivery teams have combined market knowledge about competition and experiences, as well as having sales insight on the customer. Subject matter experts bring knowledge of the approach and solutions while project managers have knowledge of timelines and resource availability. Legal personnel can also bring expertise around contractual conditions.

Different perspectives and input into the Bid/No Bid decision can reduce bias, and also uncover broader insights on risk perception that might otherwise have been overlooked.

Important to the process is the ability to override the model’s recommendation with a supporting business case for a decision, which can sometimes be the case when the pursuit is strategic.

Ultimately, gaining consensus – and documenting the reasons for the decision – is key to the successful business operations.

Practical benefits and implications of the Bid/No Bid decision

Utilising Bid/No Bid Decision tools that combine past decisions with bid win/lost outcomes and subsequent contract performance data (whether this is your own data or open contracting data of competitor activity) has the benefit of:

- Delivering more objective and reliable results with clearer picture of the probability of bidding success (with the ultimate goal to identify correlations with contract success);

- Speeding up the bid/no-bid decision process. With a simple and systematic structure where limited training is required, bidding companies can more quickly and consistently evaluate and prioritise opportunities on a set of clear categories and factors.

- Deliver cost savings by either reducing the time it takes to prepare the proposal (up to 15% to 20%), or allowing for more time to spend on preparing higher quality proposals by allocating optimum bidding resources to improve the win ratio – thereby reducing the cost of sales.

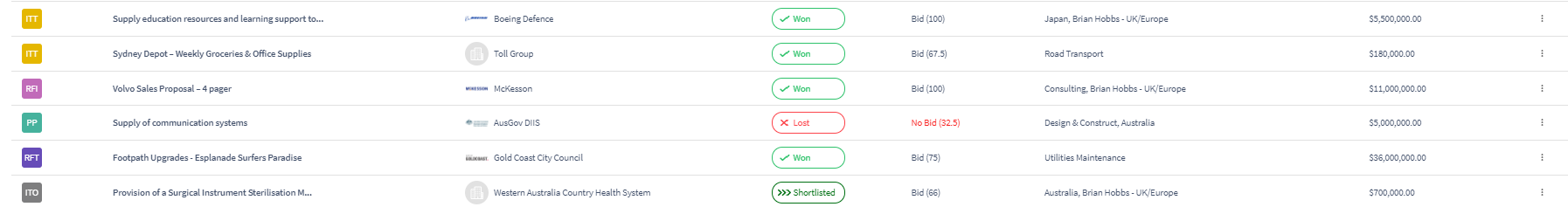

The report below shows just how simple it is to aggregate data in Bidhive to help you make not only singular decisions, but to help you analyse customer traits and market conditions based on patterns of previous Bid/No Bid Assessments.

In this example we can:

- Revisit the Bid/No Bid decisions and identify which “factors” tend to be the most influential across your customer cohorts or business lines (in this case we can drill down and see that it’s the project-specific criteria which carries much higher influence than all other factors); and where we had high confidence scores in project criteria, there was a strong correlation against winning the bid.

- Identify an anomaly in the fourth row. Whilst we scored a low score overall in our original Bid/No Bid assessment we know that there had been an executive decision to override the Bid/No Bid decision. The bid was not successful.

- Use historic data to more confidently prepare a business cases and deliver hard data and early assumptions to help with a Bid/No Bid decisions.

Our recommendation for optimum bid success is to secure early involvement from subject matter experts and technical personnel through the Capture process to fully understand the scope the requirements, discuss the proposed solution and assess the contract conditions before you make a decision to proceed with the bidding opportunity.

Other topics

Pre-bid

- Bid Opportunity Management

- The Capture Process

- Bid/No Bid Decision

Bid

Post-bid